BRICS Pay C2B gives you the freedom to explore BRICS+ and other countries without worrying about cards, currency, or how to pay. Use your own card and your own account to make instant QR‑code payments in shops, cafes, hotels, and services — just like at home, in national currencies. Explore BRICS+ countries and pay your way — with the payment methods you already use and trust. No currency exchange kiosks, no need to open local bank accounts, no special “travel cards”, no hidden intermediaries taking a cut — just seamless, compliant, cashless C2B payments that follow you wherever you go. That’s BRICS Pay: your financial freedom to travel, shop, and live globally.

Download App:

Freedom from barriers (no currency exchange, no special cards)

Freedom of movement

Imagine landing in Beijing, Moscow, São Paulo, or Dubai — and paying exactly the same way you do at home. No confusion. No extra cards. No middlemen taking a cut. BRICS Pay C2B is not just another payment tool — it’s your passport to four freedoms:

Freedom to choose your payment method

Freedom to explore the world

Get Your Payment Freedom Now:

BRICS Pay for Retail (C2B) is not a sanctions workaround. It is a convenience layer that respects all international rules while improving cross-border user experience.

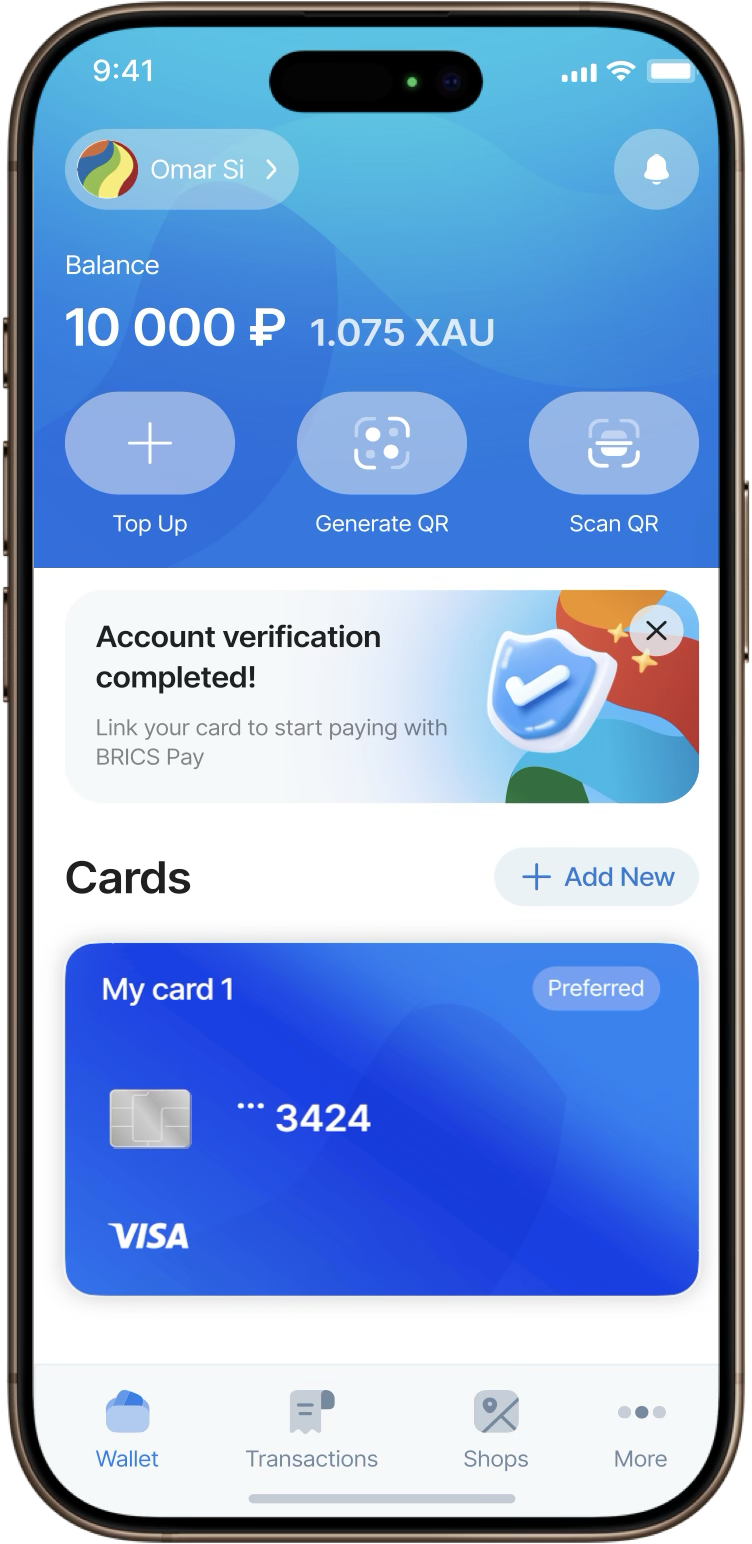

BRICS Pay enables foreign tourists and business travelers to make secure and seamless payments in BRICS — without opening a local bank account or exchanging currency. Simply link your international Visa (or Mastercard soon) to the BRICS Pay app and use it to pay via QR code at thousands of locations across the country.

* Provided that the organization whose payment is made is not included in the sanctions list.

If you see a QR code at the checkout, on your receipt, or on the terminal screen, you can likely pay with BRICS Pay. Just open the app, scan the code, and confirm the payment.

In restaurants and cafes in Russia, there is always a QR code on the checks for paying tips. Be careful when paying and ask the waiter which code to use for payment.

Download Your Travel Wallet:

Please note that the service is available to citizens of a limited number of countries. For a full, up-to-date list, please visit the BRICS Pay app.

* Stage 1. Available in Russia (Moscow, St. Petersburg, Sochi, Kazan, etc.) Later will available in other BRICS+ countries

Important: this payment method requires internet on your phone. After a while, a payment method will become available without the need to connect to mobile internet.

BRICS Pay creates new opportunities for retail businesses and national economies by enabling seamless, secure, and cost-effective cross-border payments. The BRICS Pay C2B (Consumer-to-Business) service allows foreign tourists and business travelers from BRICS+ countries to pay for goods and services using QR-code payments with their existing bank cards, without needing to open a local bank account or exchange currency.

This capability directly boosts tourism revenue and increases footfall in key commercial and tourist hubs.

For national economies, BRICS Pay reduces transaction costs, accelerates fund turnover, and supports the growth of foreign trade through direct settlements in national currencies — minimizing dependency on correspondent banking and third-party financial systems.

Designed for scalability, BRICS Pay seamlessly integrates with existing payment infrastructure, and requires no modifications to POS terminals.

We perform thorough verification of a merchnts and do not allow the use of systems to bypass sanctions or to receive payments for high-risk transactions such as gambling or betting.

BRICS Pay operates with full respect for international financial regulations:

BRICS Pay is not a tool for sanctions evasion. It is a secure, compliant, and legitimate payment solution aligned with FATF, OFAC, and national regulatory standards.

BRICS Pay App Privacy Policy

E-Commerce POS API integration. Protocol description

POS API for brick and mortar stores. Protocol description

We're finalizing the app's release.

You can leave your email, and we'll let you know when it's released in stores.